Press

For media enquiries, please contact press@kuda.com

Download Press KitMedia Mentions

Kuda, the Target Global-backed challenger bank, tripled revenue to $22 million in 2022

Kuda, the Nigeria-focused neobank backed by Target Global, tripled its revenue, according to its latest audited financial statements filed with U.K. regulators where the startup is incorporated....

Kuda, SeerBit partner on cardless payments

Kuda has partnered with SeerBit, a payment gateway, to give Kuda’s customers a safe and easy option for making cardless payments online and in the process reduce exposure to fraud.

Managing Director of Kuda Microfinance Bank shares insights on balancing innovation and compliance

In April 2024, the Central Bank of Nigeria (CBN) directed five fintechs — OPay, Paga, Moniepoint, Kuda, and PalmPay — to pause new customer onboarding. Although it was reversed in June, the affected fintechs were required to update their KYC processes.

The world's top 250 Fintech Companies: 2024

The past year has proven a transformative one for financial technology. Global venture funding into the fintech sector has declined sharply from the industry’s heyday in...

Small businesses need support to drive Nigeria’s economy for prosperity

Kuda Business, a small and medium enterprise (SME)-targeted product offering from Kuda, one of Nigeria’s digital banks, recently reached a milestone of 100, 000 SMEs...

Kuda secures payment licences for Tanzania and Canada expansion

Kuda Technologies, the Nigerian-based parent company of Kuda Microfinance Bank, has received payment licences in Tanzania and Canada to further its plans to expand across the African and global markets.

From banking giants to lending up-and-comers — here are the world’s top 200 fintech companies

From across the globe, spanning a diverse range of applications in finance — these are the world’s top 200 fintech companies.

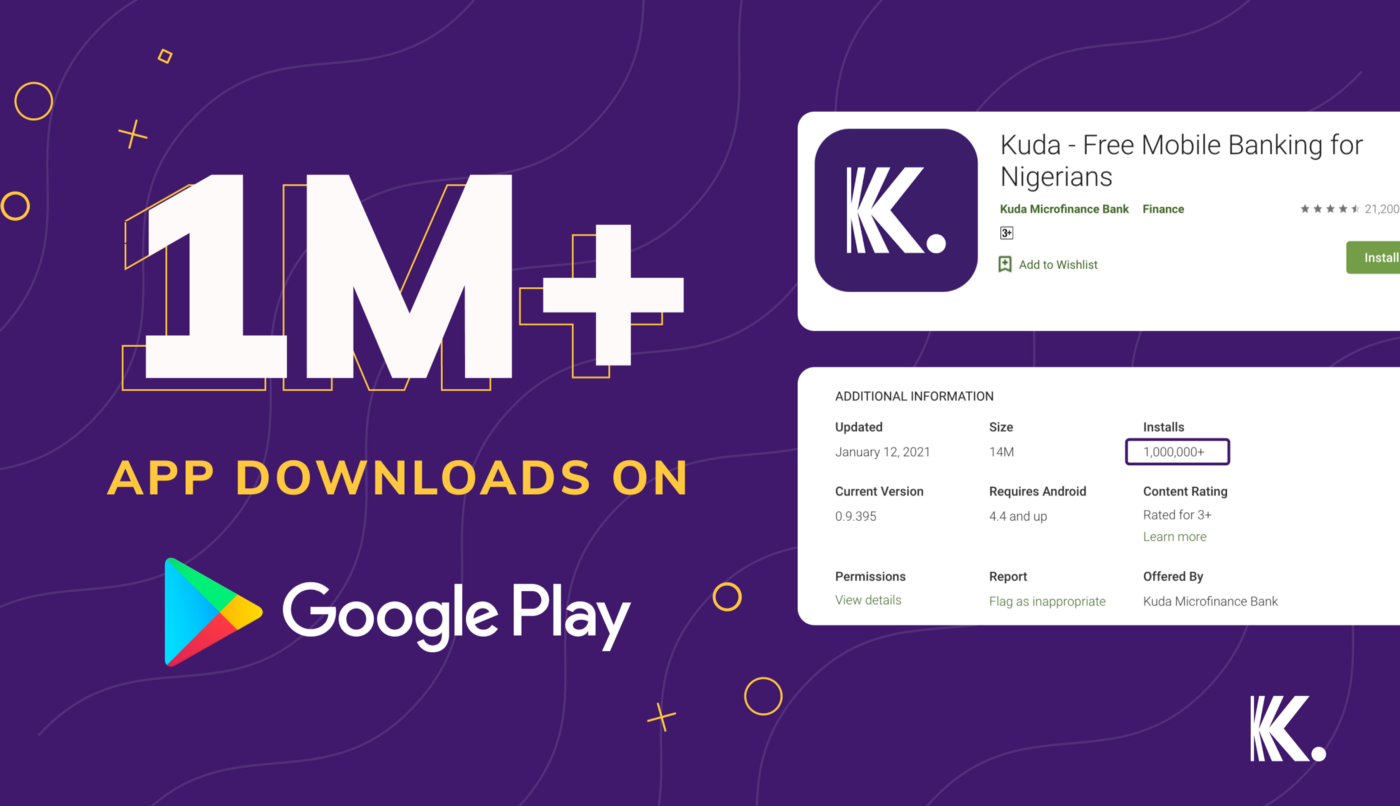

Africa-focused Challenger Bank Kuda Passes 1 Million Android Downloads

The challenger bank for Africa has gained significant traction since its beta launch in September 2019. Kuda Technologies, the digital-led challenger bank for Africa..

PODCAST: WhatsApp payments in India - exponential growth potential?

Our expert hosts, Simon Taylor and Adam Davis are joined by some great guests to talk about the most notable fintech, financial services and banking news from the..

VIDEO: Kuda CEO Babs Ogundeyi talks about the biggest startup seed funding to come out of Africa so far

kuda Microfinance Bank CEO Babs Ogundeyi spoke exclusively to the Global Business Report about the historic seed funding raise that brought in $10m..

Digital challenger bank ‘Kuda’ raises $10 million, the largest ever seed round in Africa

Kuda, Nigeria’s first fully digital bank, has announced a seed financing round of $10 million to accelerate its pan-African expansion and further develop its ethical..

Nigerian digital bank Kuda raises $10m seed funding round

Nigerian fintech startup Kuda, which is building a pan-African digital challenger bank, has closed a US$10 million seed funding round in order to accelerate its growth..

kuda Microfinance Bank’s $10m funding could send competition in digital banking to overdrive

Despite a looming threat by big Nigerian banks in the space, Nigeria’s self-styled ‘Bank of the free’, kuda Microfinance Bank may be a serious contender to the digital banking throne..

Nigeria’s Kuda raises $10M to be the mobile-first challenger bank for Africa

The African continent is currently one of the fastest-growing regions when it comes to mobile growth, and financial technology companies that are building services to..

Nigeria’s Kuda raises Africa’s all-time seed round of $10 million

Kuda joins the list of other notable startups like Paystack (which was recently acquired by Stripe) and Interswitch that crossed the $1billion valuation benchmark...

Nigeria's Challenger Bank Kuda Raises $10M For Its Mobile-First Services

Nigeria-based Kuda, which operates its own mobile-first challenger bank, now has $10 million after a funding round in what TechCrunch reported is the biggest..

VIDEO: FF Virtual Arena: kuda Microfinance Bank

kuda Microfinance Bank's CEO Babs Ogundeyi joins our host Ali Paterson in finding out who is the #1 when it comes to the financial scene in Nigeria..

Nigerian digital banking startup Kuda launches fund to fight COVID-19

Nigerian digital banking startup Kuda has launched a COVID-19 fund to help buy and distribute food and other essentials to people badly affected by the economic..

Nigeria COVID-19 lockdown: CBN calls for use of alternative payment channels

Its day one of the lockdown for residents of Lagos, Abuja and Ogun states since the restriction of movement announced by President Buhari. The Central Bank of Nigeria..

Kuda starts banking revolution in Nigeria with free transfers for all forever

Kuda, a digital-only bank licensed by the Central Bank of Nigeria, has kickstarted a revolution in Nigeria’s banking sector. Still, in beta and only three..

Kudabank: The Answer To The Problems Facing Nigeria's Banking Sector?

The repeatedly decried fees charged by Nigerian banks have heaped them with naerly a fortune. But Kudabank is offering a no-fee online bank.

Digital Nigerian bank Kuda raises $1.6m in pre-seed funding

Nigerian fintech start-up Kuda has raised $1.6 million in pre-seed funding in preparation for its beta launch as a digital bank

Nigerian digital bank, Kuda, raises $1.6 Million pre-seed funding in readiness to exit beta

And now, three years later, the rebranded fully-fledged online-only digital bank, Kuda, has raised pre-seed funding to the tune of $1.6 million from a number of angel..

Nigerian online-only bank startup Kuda raises $1.6M

Nigerian fintech startup Kuda — a digital-only retail bank — has raised $1.6 million in pre-seed funding. The Lagos and London-based company recently launched the beta..

Nigerian FinTech Kuda Raises $1.6M

Kuda, Nigeria's first digital-only bank with a standalone license, has raised $1.6 million in pre-seed funding led by Haresh Aswani.